Many landlords and property managers wonder if they can use QuickBooks to manage rental properties. After all, it’s one of the most popular accounting platforms for small businesses. But when it comes to property management—tracking tenants, collecting rent, handling maintenance, and producing owner statements—QuickBooks shows its limits.

This article compares QuickBooks directly to SimplifyEm, a platform built specifically for small landlords and mid-sized property managers.

In this article:

What QuickBooks Does Well for Business Owners

General Accounting Strengths

QuickBooks offers solid features for general business bookkeeping:

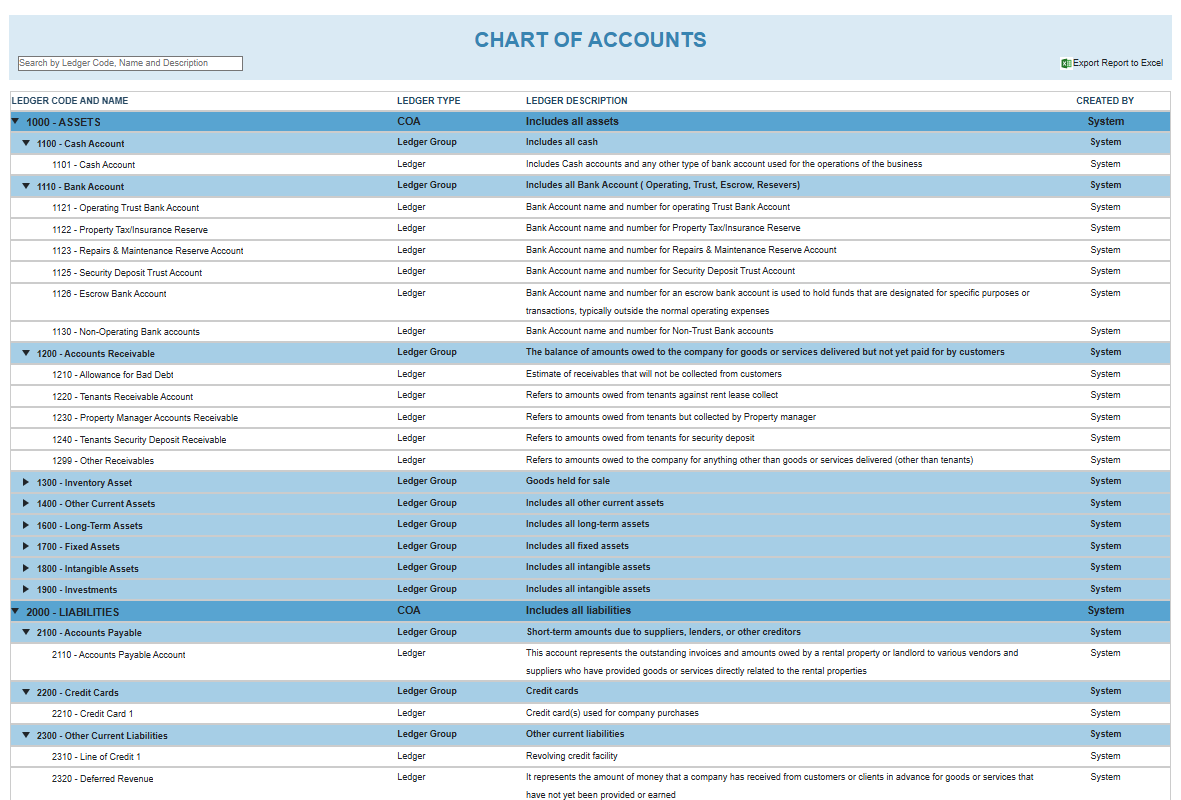

- Double-entry accounting with a full Chart of Accounts (COA)

- Financial reports and bank reconciliation

- CPA-friendly exports and tax categorization

These features make QuickBooks a powerful tool—for users with a deep understanding of accounting principles.

Why It’s Not Built for Property Management

QuickBooks was designed for freelancers, consultants, and retail businesses—not property managers or landlords. That means:

- No built-in tenant or lease tracking

- No online rent collection tools

- No maintenance requests or rent reminder workflows

Users must manually customize fields, reports, and ledgers to “fit” rental workflows—often with limited success.

Can Small Landlords and Property Managers Actually Use QuickBooks Effectively?

The Accounting Barrier

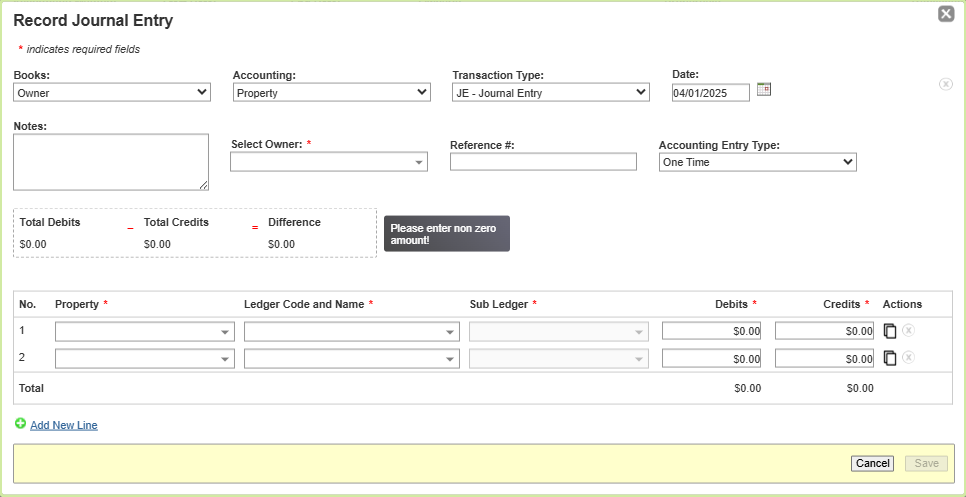

To use QuickBooks well for rentals, you need to understand:

- Chart of Accounts (COA) setup

- General Ledger (GL) principles

- Journal entries and double-entry accounting

Most small landlords and even many property managers don’t have that background. Mistakes are common—and costly.

The Result: Confusion and Errors

Without property-specific workflows, users often:

- Track rent payments manually

- Forget to post late fees

- Struggle to reconcile security deposits

- Rely on spreadsheets outside the system

In the end, many hire bookkeepers just to manage QuickBooks—or abandon it altogether.

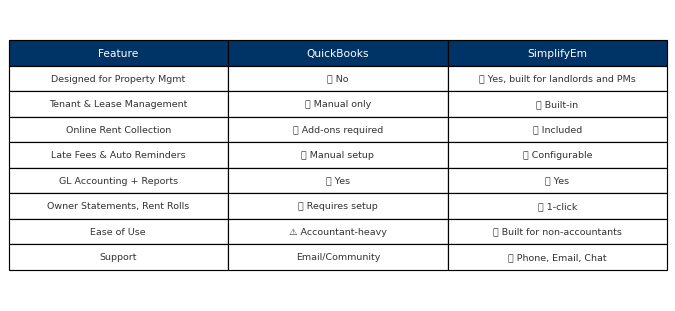

QuickBooks vs. SimplifyEm: Feature-by-Feature Comparison

Why SimplifyEm Is Better for Landlords and Property Managers

Start Simple, Grow With Ease

SimplifyEm lets you start with just the tools you need—like rent tracking and lease reminders—and grow into full GL accounting and CRM as your portfolio expands.

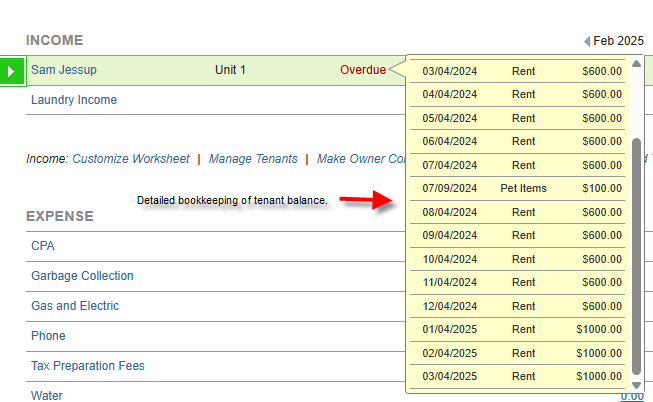

Built for Property Workflows

You can:

- Track leases and tenants

- Send rent reminders and charge late fees

- Accept online payments

- Generate 1099s, rent roll reports, and owner statements

All without needing accounting training.

Transparent Pricing, Customer Support that WOWs

- Plans start at $25/month for up to 10 units

- No per-unit fees or forced upgrades

- Support via phone, email, and chat

Explore property management accounting features

Compare pricing plans

FAQs – QuickBooks vs. SimplifyEm

Can I use QuickBooks to track rental income?

Yes, but it requires custom setup, manual tracking, and strong accounting knowledge.

Is there a QuickBooks template for landlords or property managers?

Some third-party templates exist, but they don’t include lease tracking, rent automation, or late fees.

Do I need an accountant to use QuickBooks for rentals?

Most landlords and property managers do. It’s not designed for property management out-of-the-box.

What’s the best alternative to QuickBooks for managing rentals?

SimplifyEm—it includes property accounting, tenant management, and reminders, all without needing accounting experience.

Final Thoughts: Is QuickBooks Right for Managing Rental Properties?

QuickBooks is a powerful accounting platform—but not for rental property management. Landlords and property managers who try to make it work often spend more time customizing or fixing mistakes than actually managing their business.

SimplifyEm is the smarter choice. It’s designed specifically for small landlords and mid-sized property managers. You can start simple and grow into full-featured GL accounting and CRM—no accounting degree required.

Sources:

U.S. Small Business Administration (SBA) – Choosing the Right Accounting Software

Internal Revenue Service (IRS) – Tax Information for Rental Property Owners